Oil has been much in the spotlight since the invasion of Ukraine hit headlines as countries in the West begin to wean themselves off Russian exports of the fuel. But what of ‘the new oil’, as semiconductors have been dubbed?

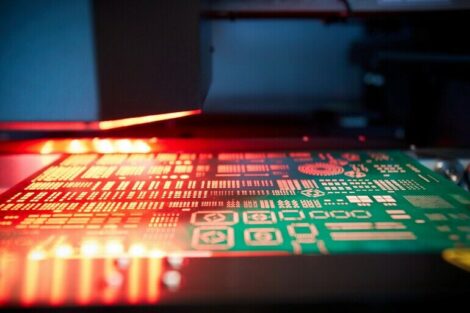

Along with South Africa, Russia is the world’s leading producer of palladium, an earth metal 30 times rarer than gold and a crucial component used in nearly all electronic devices, as well as in many semiconductor chips. Reports suggest that the country produces around 40 % of the world’s supply of the precious substance. Indeed, it accounted for 74,000 kilograms (of a world total of 200,000 kg) in 2021, and 93,000 kilograms (of 217,000 kg total) in 2020. Ukraine, meanwhile, generates 70 % of the global supply of neon gas which is used to power the lasers that etch circuitry designs onto chips. The besieged nation is also a major producer of krypton, xenon and a gas known as C4F6 – all similarly used in advanced chipmaking lithography. Complicating matters further is the fact that many of these gases are actually byproducts of Russian steel production that have been refined by specialist companies in Ukraine for use in semiconductor manufacturing. With this in mind, what impact will the Russia-Ukraine conflict have on semiconductor supply, and the electronics manufacturing industry more broadly?

“We can expect the global chip shortage to worsen should the military conflict persist,” Tim Uy of Moody Analytics wrote in a report published in early March. “This means significant risks are ahead for many automakers, electronic device manufacturers, phone makers, and many other sectors that are increasingly reliant on chips for their products to work,” he added. The automotive sector could be particularly hard hit considering both rising metal prices and potential constrains on semiconductor availability. Uy also pointed out that the 2014 crisis in Crimea caused neon prices to rise 600 % in the runup to Russia’s annexation.

Despite these warnings, semiconductor manufacturers have thus far played down the possible impact of the conflict upon supplies of raw materials. On 24 February 2022, the day the invasion began, the Semiconductor Industry Association which represents nearly all US semiconductor companies, said in a statement that, „the semiconductor industry has a diverse set of suppliers of key materials and gases, so we do not believe there are immediate supply disruption risks related to Russia and Ukraine“. Micron Technology, Intel Corp and South Korean chipmaker SK Hynix are among others who have remained stoic about potential supply issues, variously claiming that they have diversified sourcing for these gases or that their current supplies are sufficient. As Uy pointed out, however, inventories can last for only so long.

Sanctions may also play a role. Beyond any direct disruption to production and supply caused by the conflict, Moscow could decide to retaliate to the various economic sanctions the West has imposed by cutting off its supply of critical materials.

As the conflict continues, it seems inevitable that the prices of these materials will rise. At the time of writing, palladium has reached a market price of $3,158.50 per ounce, up almost 60 per cent since the start of January 2022.

Proof that the pressure on supply chains getting to some came in mid-March when South Korea’s government announced bumper government investment in chips and removed import tariffs on gases vital to semiconductor production to protect its supply.

What about Europe?

Supply chains to Europe do not yet seem to have been directly affected. “As of today, none of our suppliers had reported any potential impact,” a spokesperson of STMicroelectronics, one of the European champions in the sector, told the independent pan-European media network EURACTIV in early March. “We continue to closely monitor the situation with our suppliers and partners.”

The EU has already announced plans to boost its own semi-conductor production. On 8 February, the European Commission proposed a Chips Act which would mobilise €43 billion (of both public and private investments) to “prevent, prepare, anticipate and swiftly respond to any future semiconductor supply chain disruption”. This news was quickly followed by an announcement by semiconductor giant Intel Corp that it planned to invest €17 billion building at least new chip factories in Magdeburg, Germany: undoubtedly a coup for Europe.

In the wake of the invasion in February, European Commission President Ursula von der Leyen also warned that the bloc would “hit Russia’s access to important technologies it needs to build a prosperous future – such as semiconductors or cutting-edge technologies.”