Growth is slowing worldwide and the industry’s outlook is less optimistic than in previous quarters, although it is still generally positive, according to the results of IPC’s fourth-quarter 2019 Pulse of the Electronics Industry survey. Based on responses from 82 companies that make up a representative sample of the industry, global third-quarter 2019 sales growth, averaging 3.0 percent, was at its lowest level since the quarterly survey began in mid-2017. The sales growth the respondents predicted for the current quarter is down further, averaging 2.6 percent.

This quarter’s composite score for the current direction of the business environment also fell to its lowest level since mid-2017. It remains in positive territory, but just barely. Current-state scores for Europe and the Americas turned negative this quarter. Sales, orders and profit margins are moving in a positive direction on balance this quarter, while labor and material costs, ease of recruiting, inventories and order backlogs are having a negative impact on the current state.

The industry’s expected direction in the next six months remained generally optimistic, with all business indicators looking positive. Among the industry segments, PCB fabricators are the most optimistic about the next six months. Overall, however, the six-month-outlook score continued to weaken compared to the first three quarters of this year. This indicates that the industry expects its health to remain generally good through the first quarter of 2020 despite some slowing.

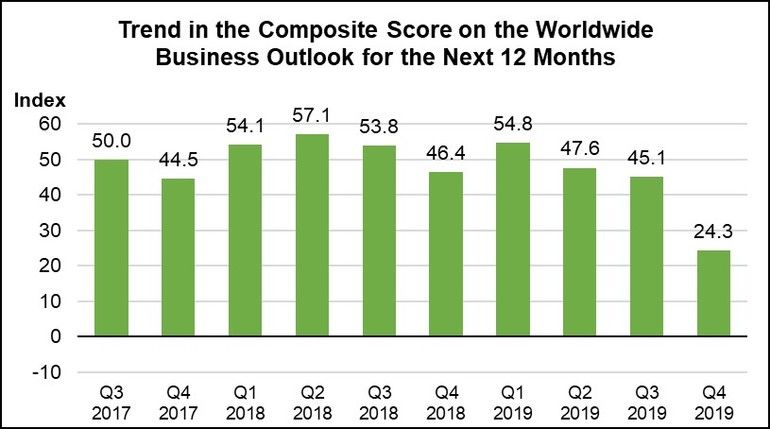

The respondents’ outlook for the next 12 months remains positive but is down substantially from previous quarters. While a majority of respondents in all segments described the 12-month business outlook as very or somewhat positive, only PCB fabricators were unanimous in reporting a positive outlook. The composite scores on the business outlook for the next 12 months are positive in all regions except Asia, where the score declined to neutral (0 on the index). The uncertainty of trade relations between the U.S. and China is a contributing factor to the lackluster 12-month outlook for respondents in Asia.

A ranking of opportunities that will drive the industry’s future business growth showed that the Internet of Things (IoT) and smart systems is seen as the number one driver, followed closely by growing markets and 5G/high-speed communications. Defense and aerospace topped the list of growing vertical markets cited by the respondents. Medical device and LED lighting markets were also cited.

Respondents also ranked a list of major concerns about conditions in the business environment in terms of their impact on future business growth. Economic uncertainty is the leading concern. Asked about conditions or trends that are significantly increasing their costs, respondents predominantly cited the tight labor market and trade conflicts.

Pulse of the Electronics Industry is a survey-based data service from IPC that provides a quarterly report on the health of the industry and its outlook for the coming year. The quarterly report shows what factors are driving or limiting growth, and how the outlook differs in various regions and segments of the industry. The confidential surveys are open to all in management positions in the electronics industry. Survey participants receive the report on the quarter’s results.