To start out with a forward looking bit of news: APEX is leaving Anaheim and is moving to Los Angeles. APEX 2007 together with the IPC Printed Circuits Expo and Designers Summit will be held February 20 to 22, 2007, at the L.A. Convention Center. For exhibitors and visitors alike this is a momentous move.

Compared to the cozy resort ambience of Disneyland-dominated Anaheim, downtown L.A. still has that gritty city feeling. But a giant building boom well underway is set to morph it to the most glamorous up-to-date urban space West of the Mississippi: six blocks of hotels and luxury residences are going up this year and next right across from the LACC. For APEX, the L.A. Convention Center should be an appropriate venue: it is in reasonable reach of major international airports, which will make transportation logistics much more convenient.

So this year was the last appearance of APEX in Anaheim, February 7 to 9 (a bit early in the calendar of many international equipment vendors after the holiday period). The mood among the close-to-500 exhibitors was quite good and relaxed; two halls of the Anaheim Convention Center were occupied. PCB fabricators are looking at annual gains of about 10 % in 2005 and 2006, driven by cell phones, notebooks and video-game consoles.

This uplifting feeling is quite significant because APEX is the economic indicator of the U.S. industry’s mood swings, not so much an introductory chute for new products and technologies – especially in the years since Productronica has taken place in Munich, Germany. In terms of technology development, the overarching theme engrossing the exhibits as well as industry forums and conference sessions was the difficult recalibration of assembly processes and materials to bring them into timely compliance with the EU directives ROHS and WEEE, which have their own problems of being uniformly transposed into their national legal environments.

The outlook for 2006 is modest

On to the outlook for global electronics as presented by the Custer Consulting Group, there is this conclusion: we are safely out of the trough of 2001. At the beginning of 2006, orders and shipments have reached the 1998 mark again, and are further pointing up. Likewise, the U.S. federal funds rate, a basic measure of the cost of credit: it’s back at the 1998 level of 4.5 % – mildly hitting the monetary brakes for fear of overheating. Only difference: oil prices on the world’s spot markets are hovering at five times the levels of back in 1998.

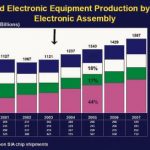

Thanks to these fundamentals, and despite the unquiet geopolitical situation, world electronic equipment production, according to Custer, will climb from $ 1,340 billion in 2005 to $ 1,429 billion in 2006 – see graph above. Asia Pacific, of course, is getting almost half of that: 44 %. But the other regions are pretty much holding on to their shares, established 2004 in the wake of the third-wave manufacturing relocation to mainland China.

A look at telecom equipment manufacturers shows, how the world has changed since. How deeply they have fallen from the top of the bubble in 2001 to the plains there are in now. The top six of them have lost 23 % of cumulated sales ($ 177 billion in 2001 down to $ 135.6 billion in 2005). Quite the opposite the trend in mobile phones. They grew from $ 414 million annually in 2000 to 810 million in 2005. If all goes well, cell phones will cross the one billion in numbers sold per year by 2009. Finally, as if correlated inversely to the deflation of the previous Internet bubble, semiconductor shipments to Asian manufacturers have risen from a 20 % regional share in 2000 to 47 % today.

EMS and ODM still small, change will come 2009

An interesting sidelight in view of the EMS/ODM debate: The EMS/ODM’s share of global revenue compared to the total available is still small. And no major change in this division of labor is in sight through 2009. While ODMs, not surprisingly, dedicate themselves to computer systems, EMS providers are more evenly spread in terms of their customers‘ products (see graph below).

The focus on profitability, as dictated by institutional investors, is continuing to pinch all market participants. To the EMS/ODM segment, this brings new challenges. China and Taiwan are seeking global market positions and brand identity. In terms of component supplies and material costs, there has been some strain on price and availability showing up last fall. Assemblers are rethinking China as a low-cost area – due to logistics issues, rising wages and a stronger currency. The alternatives: India, Vietnam, Mexico and – Central Europe.

The view after APEX: 2006 is shaping up as a year of modest global growth, but not as a replay of 2001. Also of some structural shifts: the supply-chain strains of the 2005 consumer goods season have probably pushed some business back to the U.S. and Europe. A number of markets are enjoying continued “organic” (meaning: tech-driven) growth, such as datacom or medical. Others are politically protected, such as the military. Still others are volatile or seasonal, such as consumer goods – on which the electronics industry has come to rely for its long-term health.

Werner Schulz

Share: