About 15 years ago, Farhad Farassat and his colleague Said Kazemi took over Delvotec in a management-buyout. They acquired the worldwide-present bonder specialist from the then owner of Emhart Dynapert, the Black & Decker Corporation. Delvotec itself was founded some 30 years ago, and is said to be one of the technologically leading bonder suppliers. After such a long time in this demanding business, it seems worthwhile to look at the company and the developments since, and what is planned, as well as discussing the expectations in the wake of radical changes in the global scenario.

I remember when you, Dr. Farassat and your partner Said Kazemi took over the company. In a pictorial sense, it was like flying a huge airplane for you, but at that time you were only used to navigating smaller ones. As it turned out, you apparently had a pilot license. Lets have a brief look back at the company’s history.

It’s been 30 years since Mr. Deubzer, Mr. Birgel and I founded Delvotec. At that time I was the designer and the R&D manager, was doing design work, etc. Even today I keep an eye on everything that we do here. Under my responsibility, we developed the mechanical and electrical parts of the bonding equipment. Right after we started we had the first machine ready for our customers within 18 months, a fully automated gold-wire bonder without pattern recognition. From the beginning we delivered our solutions to well-known companies in the electronics business. In 1978 we brought the first aluminum twin-head bonder for transistor manufacture into the market. This was a real breakthrough, delivering almost twice the throughput, and we received a lot of orders for it from all over the world. This machine featured pattern recognition. We were the first worldwide presenting such an outstanding solution with a vision system. About a year later we were also the first with an aluminum bonder including a rotary head, not a rotating table to be used for IC production. The next innovation – again a worldwide first – was a fully automated aluminum heavy wire bonder for power transistors.

Did these innovative solutions mean the business grew dramatically?

In the beginning it did. However, after a few years we experienced that the annual sales settled in at around 5 million marks. The owners later sold the business to Emhart where it was part of Dynapert, their semiconductor equipment unit. The new owners tried to turn the company into a huge major player. The highest annual sales figure we ever reached was 10 million marks. Despite all efforts, we understood that this was the end of the flagpole at this time. Then it happened that Black & Decker acquired Emhart in the US. However, the professional equipment part of Dynapert did not really match the consumer-oriented corporation. As a result, my partner and I agreed to buy Delvotec in a management buyout at the end of 1992. The company had a staff of 40, and the annual turnover amounted to 10m DM. Within the following three years we reached sales of about 23m DM, and in seven years about 100 million DM. Compared to the starting point, this was a factor of ten, and a remarkable development. No wonder then that I won the ”Entrepreneur of the year” Award in 2001 in Germany (out of a total of 2000 candidates). The year before I was among the top fifty. At the time I didn’t even have German citizenship, but this changed soon afterwards.

There must be a secret behind this success…

A secret called hard and efficient work. When we first began, we had to resolve concerns from key customers because we were small and no huge corporation was behind us. As these partners realized that we were doing good work, even more orders came in, built on mutual trust. We listen to our customers very carefully before we decide the next developmental step. We do not have legions of designers. But regarding our patents and machines, it becomes clear that that we were first with many major innovations. And very importantly, we have a strong customer orientation and provide outstanding service and support. Our machines distinguish themselves with state-of-the-art technology, high-precision, and high-quality solutions. I’m not just saying that – that’s what we do every single day. And we are deeply involved in technology talks with our customers. They know what we intend to do in the next few years, and we know which production solutions they expect. Our machines feature high reliability. To illustrate this, our business with spare parts and service is less than 10%, whereas other companies have around 20% of their annual turnover in this segment.

About two years ago you sold your die-bonding business to the Siemens business unit Electronics Assembly Systems (Siplace brand). What happend after that?

This provided the opportunity for Siplace to integrate our technology into their SMD placement equipment. For example, they use the technology in a placement machine taking up to four wafers in the feeder system. A solution which quadruples the throughput of such machines. We decided to sell this business in which more than 20 years of technology experience are embedded.

How did you survive the recession between 2001 and 2004, when the dot-com bubble burst and the electronics commerce collapsed?

We could of course not escape the general trend. First our sales declined from euro 50m to 40m and later even lower. Some of our key customers reduced their manufacturing operations dramatically. I tried to keep our team full strength, although we had quite a few people too many for the situation back then. It was inevitable that we had to reduce staff in order to protect our company. However, because of our good will as responsible managers and owners committed to our people, and enough money in our bank account, we were able to withstand these three difficult years, and in turn were able to utilize them as the starting point for the design of a new machine platform.

What bonder equipment we are talking about now?

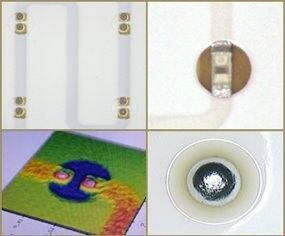

Well, this is our generation five (G5) bonder platform which won – as did our G4 model a few years before – the Best Product Award. Even the excellently performing G4 with their linear motor drive and a working area of 8 x 6-in (200 x 150mm) can still be ordered. But we now cover about 70% of our sales on new machines with the G5, introduced into the market at the end of 2005. I can assure you that the design of the current platform strictly followed our customers´ requirements, collected over a period of time beginning in 2002. With the G5, we raised the sales of new machines from 2006 to 2007 by about 40%. With this highly versatile concept we can react to diverging requirements from different market areas such as fully automated high-volume production or relatively small manufacturing environments with manual handling. The other key issue is cost of ownership. The feedback of our G5-customers tells us that they are in the range of only 1,000 euros annually. Other machine users have to spend between 4,000 and 10,000 euro per machine and year.

How many wire bonders platforms do you have?

Only one in the G5 series. We had two platforms before in the G4. The G5 has become our standard wire bonder platform for fine wire, heavy wire and small and heavy ribbon bonding. Depending on the respective application, it works with gold, aluminum, copper or insulated wires. And it also encompasses all bonding technologies such as wedge-wedge, ball-wedge, bumping and TAB (tape automated bonding), and also large area solutions for hybrid manufacture. On this machine platform, all bond heads such as twin, rotary, etc. can be universally operated. Again this is a first in this business, a brilliant concept for high efficiency. In the G5 series we have realized another first, a rotary head gold ball bonder. With this machine, highest possible quality is reached in all bonding directions. Other machines suffer from undesirable variation when bonding in different directions, but our machine provides the best welding connections because the rotary head is always working in the transducer direction, avoiding weak bonds. With our many patents in bond technology we are a forerunner for a host of solutions – and copycats prove that the original idea was brilliant.

Let’s please have a more detailed view of the G5…

This breakthrough platform is a real high-tech invention in every respect: mechanically, technologically and in its inner workings. I assume many people will realize in two or three years what we have designed and put into this. For example, where others use the standard PC technology, we employ a compact computer on a single board. Another feature is the use of advanced linear motor drive technology allowing higher speed and safer, smoother working cycles, and which is practically wear-free. We are now working with a tiny linear motor resolution of 0.01µm, a mere 10 nanometers. The software environment was also designed using the latest technologies, and runs under the Linux open source operating system. The advanced process system monitors the entire bonding process and detects potential defects just when they are about to happen, instead of later during the quality assurance of the chips. This would definitely be too late. With this real-time information, the customers can control their production in a closed-loop system, maintaining zero-defect manufacturing. It goes without saying that we have a patent worldwide, and we do not sell licenses. The next machine innovation will be a separate, not machine-integrated, post-bond inspection unit which allows customers efficient control of their zero-defect production. With this unit we can make sure that the parts produced on our machines are totally free of bond defects. We are the supplier who assures our customers a defect-free production which is unique for the bond process. In a nutshell: we’ve implemented the newest technologies in our G5 in every respect.

There is a nice figure in the equipment market, concerning the installed base. What can you say about this?

Regarding all equipment, from the very beginning of the company, this must be a huge number. Let’s say it is far more than 3000 machines worldwide. What is interesting to see in this context is that we have customers operating machines that are about 20 years old and still perform according to their specifications in the designated application. What’s really a surprising fact is that we are the only bonder supplier worldwide who provides support for this old equipment. The users of these vintage equipment will still get spare parts on a fair cost base. The standard of other companies is 5 to 8 years. Since we continuously make updates and redesign our hardware, we do not rely on discontinued, non-available semiconductors. Other companies post an announcement of equipment discontinuation, giving the customers the opportunity to stock-up on spare parts of those machines in use, and then terminate a product line. This may appear useful from an economical point of view, but we have a different understanding of what is meant by excellent long-term customer support and service.

The over-valued euro has brought many machine suppliers into a critical situation, moving out into Asia or Eastern Europe for example. What can we expect from you?

As long as it is possible, we will build our machines or its vital core components in Germany and Austria, since this assures the best possible quality. Of course, every machine supplier who produces in the euro zone suffers when he delivers into the dollar area. Since we have to deal with a rise of over 30% of the euro against the US dollar within a single year, this is a serious issue. And it’s clear that we have to take measures to stay financially healthy. We are discussing different ideas and opportunities. There could be an option for buying certain parts or modules from abroad, but always being aware that the heart of the machine quality, the vital element that also contains our core competence, has to come directly from us. There is another option for engagement outside the euro zone in a safe place where we can expect high quality and at the same time lower our production expenses, and like everybody else in this business we are looking at all options we have.

Investors either acquire many of your competitors at company sites in Europe which have closed, or have gone public and became extremely vulnerable and weak. Was “going public” ever an option for you?

No, not really. We are still a privately, owner-held business. I personally feel deeply committed to this company and its people. We are not the entrepreneur types who want to make fast money on the stock exchange when flogging off the business. That’s not an alternative for us, since we would no longer be the owner and the people in charge. We would instead have so-called financial analysts, investors, consultants, etc. permanently asking us: why do you produce in Germany where it is so expensive? We’d have too many people here making decisions, we’d have to close and relocate to cheaper production locations and so on. Some companies in this business have gone into deep trouble in this way. For example, looking at the current financial crisis, I can see what a bad job that class of overrated managers or experts has done.

This leads to another question. The equipment market is weak. SEMI sees meager numbers for this year, but in virtually every product we buy there is electronic content. Therefore, demand is visible and manufacture has to follow suit.

That is now an issue with worldwide banking. When companies apply for credit in order to make urgent investments in their production lines, even in these cases the finance world is extremely hesitant. In this situation it is very hard for companies to get their capex investments through. It is noteworthy that these companies want to invest in assets needed for production in order to earn money and to pay the money back to the lender. This is not a foul sub-prime credit deal. This capex financial gap will probably last a few months longer. However, at the end of this year or during the following year, even more manufacturing companies have to invest in even more capital equipment. At the end we can expect an investment wave in capital equipment. (Interview conducted by Gerhard B. Wolski)

SMT, booth 7-206, 9-404, 9-411

Share: