According to a new report by DMASS Europe e.V., a non-profit industry body that collates detailed electronic components distribution market data on a quarterly basis by country, European components distribution has now reached the tail end of a longer than expected growth period and is now experiencing a market contraction. In Q3/2023 the market declined by 5.6% to 5.15 billion Euro. While semiconductors went down by 3.2% to 3.65 billion Euro, IP&E (Interconnect, Passive and Electromechanical) components declined by 11% to 1.5 billion Euro.

“Considering the situation of a 3-year growth stretch with heavy allocation across most components’ segments, the current slowdown is not unexpected,” said Hermann Reiter, chairman of DMASS. “As inventory levels are still high, we are seeing weak bookings for the time being. 2023 will probably end slightly positive at high revenue levels, 2024 will require our patience until a substantial turnaround of the demand side will occur. Long-term, our expectations remain positive, especially for distribution in Europe and all the industry segments we serve.”

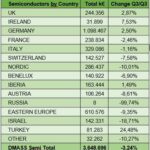

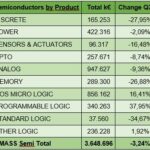

Semiconductors (Q3)

At a total revenue of 3.65 billion Euro, semiconductors showed a slight decline of 3.2% at a still healthy level. Regionally, only a few countries or regions remained positive (UK, Germany, Turkey), the rest slid into slowdown. From a product perspective, most product groups showed negative growth, except for MOS Micro, Programmable Logic and Other Logic.

Interconnect, Passive and Electromechanical Components (Q3)

In IP&E, the slowdown that was already under way since the beginning of 2023, continued in Q3. The IP&E distribution market declined by 11% to 1.5 Billion Euro in the summer quarter. Regional differences were much more obvious than in semis: Of the bigger countries Germany was hit hardest with nearly –17%, while France only declined by 2.3%. The only country with positive growth was Turkey with +28%. On the product side, Power Supplies suffered the least, while Electromechanical components (including Interconnect) declined by 9.3% and Passives by 14.4%.

“Very often over the last few years, the term ‘unprecedented times’ has been used to describe an anomaly in a genuinely positive market like electronic components,” Reiter added. “I am pretty sure that we will see more unprecedented and unpredictable times in the future. However, despite all current geo-political challenges and potential disruptive forces ahead, the long-term outlook for our industry overall not only remains positive, but we will see ‘unprecedented’ dynamics, not the least driven by Artificial Intelligence and Quantum Computing.”