Intel Corporation has announced it has entered an agreement under which Apollo-managed funds and affiliates will invest USD 11 billion to acquire a 49% equity interest in a joint venture (JV) entity related to Intel’s Fab 34.

Under the agreement, the JV will have rights to manufacture wafers at Fab 34 to support long-term demand for Intel’s products and provide capacity for Intel Foundry customers. Intel will have a 51% controlling interest in the joint venture. Intel will retain full ownership and operational control of Fab 34 and its assets.

This transaction allows Intel to unlock and redeploy to other parts of its business a portion of this investment while continuing the build-out of Fab 34. As part of its transformation strategy, Intel has committed billions of dollars of investments to regaining process leadership and building out leading-edge wafer fabrication and advanced packaging capacity globally.

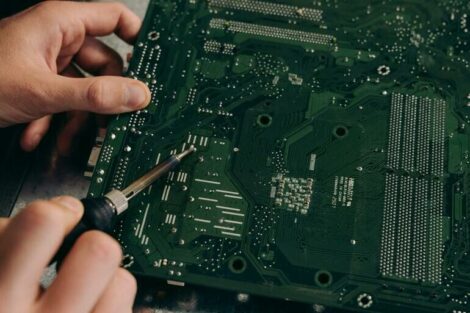

About Fab 34

Located in Leixlip, Ireland, Fab 34 is Intel’s leading-edge high-volume manufacturing (HVM) facility designed for wafers using the Intel 4 and Intel 3 process technologies. To date, the company has invested USD 18.4 billion in Fab 34.

“Intel’s agreement with Apollo gives us additional flexibility to execute our strategy as we invest to create the world’s most resilient and sustainable semiconductor supply chain. Our investments in leading-edge capacity in the U.S. and Europe will be critical to meet the growing demand for silicon, with the global semiconductor market poised to double over the next five years,” said David Zinsner, Intel CFO. “This transaction allows us to share our investment with an established financial partner on attractive terms while maintaining our strong investment-grade credit rating.”

Apollo Partner Jamshid Ehsani added, “Apollo is pleased to enter into this joint venture with Intel. This highly strategic capital transaction is among the largest private investments of its kind and showcases Apollo’s ability to provide creative, scaled capital solutions to leading corporations and infrastructure, and to contribute to supply chain resiliency. It also underscores our role as a trusted financing partner, leveraging private capital to help build the New Economy, including next-generation AI technology which will require major investments in sustainable power generation, data centers, foundries and semiconductor capabilities.”