Once again, Semicon Europa is approaching in Munich’s Trade Fair Center: from April 19 to 23 different course programs and seminars will be running, and from April 20 to 22 the exhibition is on. Semi executive Walter Roessger is delivering a show forecast, “The booth number is about 1550 and we expect more than 850 exhibitors, so a visit will bring a wealth of information and answers to many pressing questions in our business”.

More than 850 companies will display the latest manufacturing technologies for semiconductors, flat-panel displays (FPDs) and micro-electromechanical systems (MEMS) at Semicon Europa. The net space is approximately 14,000-sqm. Compared to the glorious days of 2001 (with 22,400sqm and 2112 booths) it seems the upturn is not yet fully complete. The exposition, now in its 28th year, is presented by Semi, the global industry trade association in this business. In conjunction with the exhibition, five days of technical conferences, business programs, international standards meetings and technical courses will run at the Munich International Congress Center (ICM), and the annual Europa Fab Managers Forum will be held in Grenoble (France) on April 23. “This event provides a platform for the exchange of ideas and the development of relationships that enable the expansion of business opportunities and advancements in semiconductor, FPD and MEMS manufacturing technologies,” Walter Roessger emphasized.

Programs/education for all purposes

A new feature of the show will be the Intellectual Property Seminar on April 22. The seminar, which will address business and legal aspects of IP, will bring patent attorneys, researchers and business executives together involved in semiconductor IP. Another feature will be the seminar How to do business in China on April 21. MEMS technology will be highlighted during the one-day forum on April 19, focusing on opportunities and challenges in the production and commercialization of those products. In addition, this manufacturing technology will be featured in a special exhibit, the MEMS Manufacturing Technologies Pavilion, located in Hall B3.

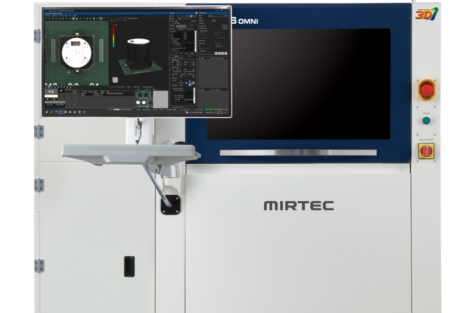

Automated handling systems, advanced tool or process control techniques for productivity will be the focus of several educational programs and standards task forces as well as of the Factory Automation Pavilion, located on the show floor, where companies will present their solutions. The FPD conference from April 21 to 22 will feature technical and business sessions on emerging display technologies such as OLEDs, FPD manufacturing strategies, and the global and European market outlook. The winner of the Semi European Award will be announced on the first day of the exposition. The award recognizes outstanding contributions to the advancement of the semiconductor manufacturing industry in Europe.

A highlight of the exposition is the Fab Managers Forum, which will take place in Grenoble on 23 April. The event, now in its eighth year, provides a platform for wafer-fab managers, executives and professionals to debate issues in semiconductor manufacturing. Other program highlights include the Sixth European Manufacturing Test Conference and the Advanced Packaging Conference, both on 19 April; the SEMInvest conference, also on 19 April; the SEMI market briefing on 20 April. The Semicon week also serves as the industry venue to advance semiconductor-manufacturing standards in Europe. More than 45 international standards events, including task-force meetings, technical committee meetings and standards technical education programs will be held during the week. MEMs-related standards will be addressed in five separate meetings.

Now, the only way is up

Looking at the semiconductor business, there is obviously a clear upturn to see in semiconductor sales, despite the moderate margins in pricing. But from their deepest position of about $0.4 (average selling price) during the recession, this value now slowly creeps to $0.5. According to diverse market research firms which have published figures ranging from 19 to up to 26% growth, a stable trend for semiconductor market growth in the area of 20% can be recognized. This would mean from $140bn in 2003 to probably more than $190bn this year. Also the global equipment and materials industry, having encountered a dramatic fall in sales from more than $40bn in the glorious days of 2000 to less than $20bn in recession-plagued 2002, is expected again to slowly rise from $21.37bn in 2003 to about $30bn in 2004. The global wafer fabs are now operating at production capacity of between 90 to 100%; with such utilization, a larger investment in capital equipment is now within reach.

A more detailed look into the market reveals that two European-based companies are under the ten leading semiconductor suppliers: Infineon at rank 7 and Philips at rank ten. In 2004, the largest semiconductor market is still Japan with $46bn (+20%), followed by the Americas ($37bn, a plus of 16%) and Europe with $36bn (+14%). China is expected to grow by 35% to about $28bn. All other markets amount to $50bn und will grow with 25%, as Semi has publicized. When we look at the manufacturing side, in terms of wafer starts per month, Europe is third behind North America and Japan, tightly followed by Taiwan. New fab capacities until 2006 will grow in Europe by 11 %, the Americas 17%, Japan 12%, China 18% and Taiwan with 26%. The then expected global semiconductor market of $280bn will be consumed by comparable portions of 18% in Europe, Americas and Japan, 20% in China and about 26% in other Pacrim (Asia Pacific) countries. From these statistics and expectations we can see that the “old” semiconductor triad Europe, Japan and America will gain comparable market sizes. Europe will then gain relatively more volume, but the music plays in Asia.

The capex question

A highly topical question for our industry is: when and to which degree will the semiconductor manufacturers invest again in new or replacement equipment? As already outlined, for this year capex (capital expenditure) of $30bn is expected from the Semi members (a plus of 39% compared to the last year) across all technology segments and application areas, and for 2005 approximately +18% will put the investments to $35bn. But in 2006, when new fab capacity goes into production, the industry capex is expected to contract 6.6% to $32bn. It becomes clear that this is a highly cyclic industry in which the executives have to be very smart in following the trends or, better, in expecting the unexpected. In the so-called foreseeable future, all regional capex volumes are expected to grow, but highest marks will obviously be reached in the Asian region.

Statistically, there is still a remarkable investment gap in the capex where an average of 25% of semiconductor revenues was reinvested into equipment in the past, since the actual value amounts to about 18/19%. At the moment, about 50% of all semiconductors are produced from 300mm wafers. The move to the large Si-disk is not provided in some single steep steps, but on an evolutionarily continual development – slowly but inevitably. This of course has something to do with costs. When in the mid 90s a complete wafer fab could be installed, needing an investment of about $1bn, ten years later the expenditure is 2.5bn. In the total cost statistic, labor was 46% ten years ago and depreciation 15% of the pie. Now labor is 12% and write-off 45%. This clearly reveals that investments in wafer fabs can only be afforded by huge and well-suited organizations to cover the global market and get the gigantic investments back.

Gerhard B. Wolski

EPP EUROPE 403

Share: