Judged by critical measures, Apex was a success again this year. Unlike other current show attempts on U.S. soil, it is still around and growing – by 5% in terms of attendance to a total of 10,900 – when generously counting in about 5,000 exhibitor personnel. A total of 484 exhibitors crowded the show floor of the cavernous Anaheim Convention Center, meriting the label “sold out” according to the after-show assessment of its sponsor IPC.

Coming out of a very prosperous 2004, the good mood at Apex 2005 carried on: almost exuberant. Smiling faces abounded – despite the fact that, as a manufacturing location, the U.S. is dealing with a similarly massive outflow of traditional companies and sensitive technology as Western Europe is. The labor-market statistics across the continent clearly reflect the low-cost labor lure of India and China. Nevertheless, Apex – which includes the IPC Printed Circuits Expo, Designers Summit and Electronic Circuits World Convention, all within short walking distance – has become the premier U.S. electronics-manufacturing venue. “We are excited by the industry’s response to the event”, IPC president Denny McGuirk remarked. “The feedback has been overwhelmingly positive”.

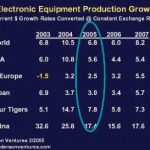

Equally positive, if a touch more moderate, is the outlook for 2005 as presented by industry analyst Walt Custer. “Modest growth appears likely”. But the global expansion is slowing from its recent peak. Rising energy costs and interest rates are likely to take their toll. “Managing a highly cyclical business will remain a challenge”, although, he believes, “2005 will not be a replay of 2001, as inventories are under better control. South East Asia has captured most volume production”.

A specialty of the U.S. electronics manufacturing is the strong military market, with an expansion 2001 to 2004 appears to have run its course and is now tempering due to budget constraints. On the other hand, consumer markets, such as mobile phones, will further expand, having shipped over a billion PCBs for handsets in 2004. Telecom and computer markets, including digital media, should pick up the slack nicely. A call for caution, Custer says, is that world PCB production totaled $38bn last year, but most of it, not surprisingly, took place in China, South Korea and Taiwan, with the U.S. and Europe being quite flat. And much of this growth occurred in early 2004.

“2004 was the best year we ever had”, confirms Richard Heimsch of DEK, one of Apex’s founding fathers. “There is certainly recovery shown by market measures that prove this value-wise”. However, “There is a permanent change of the manufacturing paradigm, not just in electronics, which is caused by various ultra-low-cost labor environments”. Is all hope lost for the industrialized West? “I recall the time 20 years ago when the Japan miracle came to the U.S. automotive industry”, Heim reminisces. “People then were saying that a car would never be built again in the U.S. And now, in the last five years, the most modern automobile factories have been built here after the manufacturing models were revised”. Is a revision of electronics manufacturing due as well? “It’s essential that we have more investment and innovation, more attention paid to science, basic research and engineering”, he answers. “It’s interesting that France, based on its high-tech business, validates this principle”.

In the same vein, if slightly different since operating in a different industry segment, is the assessment of Patrick Trippel of Henkel. “The U.S. had good growth last year, with Europe only starting out in the second half. Asia as a whole was very strong – China being the fastest”. For him, the transition to lead-free soldering was the main issue at Apex. “It’s not done yet, people are still qualifying”, Trippel says. “It’s an educational process, because it is difficult. But U.S. manufacturers are pretty much in line now with European regulations”.

Lead-free is the big-time issue for Jeroen Smits of Vitronics Soltec as well. “If you compare this to a technology adaptation curve, we are still on the left side of the curve”. Shifting RoHS deadlines and legal uncertainties surrounding them, Smits says, are a problem. “What was initially seen as a technology challenge is now a logistics challenge. That may even be the bigger intimidation”. Good news from China: Vitronics-Soltec somehow managed to get a 100% self-owned fab up there – no joint venture.

The recovery is here

For Kester Solder, says David Torp, the big issue last year was the move to Germany to better supply Eastern Central European EMS locations. About 35% of Kester’s lead-free materials sales, he says, are going to Europe.” We see it as the next geography-swing to lead-free, with the U.S. being third”. Same happy tune sung at Viscom. “Last year was a great year”, says Carsten Salewski. “We are market leader in Europe, which means $57m worldwide – giving us a pretty good third place among the top three AOI suppliers”. Automotive being Viscom’s main market, now the smaller and medium-size contract manufacturers are coming up. “We have a good backlog”.

A skeptic among the lead-free transitioners is Leigh Gesick of paste provider Amtech. “The general concern among users and suppliers is that we won’t get the like of a 63/37 joint in terms of reliability, cosmetics and cost of processing”. Users of wave soldering machines, Gesick contends, will have to spend $20,000 and more to retrofit. Despite the transition doubts, the company is doing well. “The recovery is here but not as quickly as expected”. The show, Gesick says, is working well: “It’s a good value, much better than in the past”.

Sporting its 324 feeders, Mimot’s Advantage 3 generated much attention as “the world’s most flexible pick-and-place machine”. Flexibility and shorter changeover times are its most visible features. “With its ‚Triligent‘ (triple intelligent) feeder system, Mimot’s American sales manager Joerg Widmer says, “the operator can change feeders on the fly with no downtime – that’s ultimate flexibility. When the first job is finished, the feeders for the second job are already waiting and production never stops”. Similarly, flexibility and affordability have driven the design of Juki’s KE-2055R multi-nozzle vision system. With image recognition, the machine places components down to QFP, CSP and 020– size. “The KE-2055R”, says Gerry Padnos, “complements our existing line. It creates a more affordable solution for manufacturers that do not require large component capabilities”.

Siemens Logistics and Assembly Systems showed its much-touted Siplace X-series to local audiences for the first time and was clearly another attention getter at the show (see EPP Europe 1/2 for full details). Günter Lauber, confirming the positive results, “We are extremely satisfied with the interest in our entire portfolio of machines, software and services. The U.S. with its high-mix and flexible production environments is one of the most important markets for the X-series. As the most flexible system available on the market, it’s the ideal machine for this market”.

Universal, highlighting the high-budget, multi-faceted R&D done at its NY State-based SMT Laboratory, set out to demonstrate flexibility and scalability in its product strategy. Based on its platform concept (Advantis and GSM Genesis) of placement machines, the company introduced the Polaris Assembly Cell for end-of-line and odd-form placement, complemented by its Dimension software for machine and line-level process management. No less than a sort of revolution in real-time microfocus X-ray inspection promises X-Tek Systems with its Revolution machine. It widens the viewing angle to 70° and allows for 6,000x magnification at all angles over the 16 x 16-in (460 x 460mm) scan area. Special to the design is the cable-free X-ray tube (which took the better of ten years to develop). The result: extremely stable, low-maintenance and easy-to-exchange filaments – and reportedly a low price point. Of the many brands of OK International, Techcon Systems, a provider of fluid dispensing systems, introduced the digital-timer DX-300/DX-315 series of mid-range digital dispensers/controllers. Metcal launched a high-performance, multi-user fume-extraction system, the MFX-2200. It improves airflow by 50%, Hepa filter size by 300% and carbon-gas filter capacity by 600%. Up to eight manual assembly stations can be serviced. Tip extraction is the alternate way: the lightweight BTX-208 serves eight stations. Digitaltest, at the occasion of its 25th anniversary “joining the leaders of electronics manufacturing”, was present with its MTS board-tester series. Featured this year was the MTS30 tester with National Instrument’s LabView and Test Stand software tools.

Coming from the Nordic region of mobile-phone popularity, Elektrobit of Finland (which acquired former Jot Automation years ago) announced its MiniRouter, a desktop router. Several of the small-footprint units can be operated in parallel for the same product, in cost-efficient small-batch production floors. Feinfocus came with its X-ray system Cougar-VXP unleashed. The versatile platform addresses inspection topics from failure analysis to high-end SMT application. Especially in the U.S., for a company to get an industry award is like getting a medal of honor – especially when coming from an organization such as Frost & Sullivan or others. So, it was a celebrated scene when German Phoenix X-ray was presented with an award, highlighting that the company has done something useful for its customers. Importing CAD files to an X-ray machine and using its programming capability to that purpose, said Boris Mathiszik, “is one of the cornerstones of the company’s effort to bring a higher degree of automation to semi-automatic X-ray equipment”.

Werner Schulz

EPP EUROPE 407

Share: