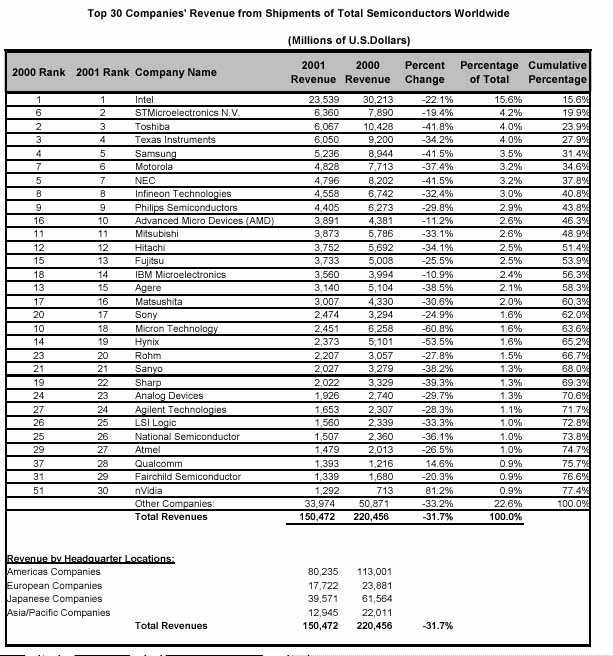

iSuppli Corp.’s final 2001 semiconductor market share findings dramatically illustrate the disastrous effects of the industry’s worst-ever downturn on chip suppliers. „The seismic forces that rocked the semiconductor industry last year reshaped the competitive landscape, bringing major changes in the rankings of the leading semiconductor suppliers“, said director Dale Ford. „Only three of the top-ten companies and just six of the top-30 retained the same ranking in 2001 that they had in 2000.“

The market share data also reveals that the global semiconductor industry shrank by 31.7% in 2001. The median growth rate for the 172 companies included in iSuppli’sresearch was minus 26.8%. The hardest-hit companies included semiconductor makers that are heavily dependent on the DRAM market, which suffered a horrendous year. As presented in the table, Toshiba and Samsung both saw their revenues decline by more than 41%. This resulted in a drop of one position in their rankings to numbers three and five, respectively.

The findings of the semiconductor market share research, which were released today, indicate also the following:

• Only 27 out of 172 companies covered in the research actually experienced revenue growth in 2001

• Out of 49 semiconductor market subcategories, only one segment grew in 2001 – the32-bit microcontrollers

• Only five out of the 50 semiconductor companies with revenues more than US$500m achieved growth in 2001. Just three of the five grew purely organically, without relying on acquisitions

Companies that managed to limit their losses emerged as the winners, although the term „winners“ applies only in a relative sense. Among the companies that weathered the harsh climate of 2001 was STMicroelectronics, which jumped from sixth place to second position in total semiconductor sales, with a decline in revenue of only 19.4%. This was the best performance of any top-10 company from 2000. Just another surprise: nVidia, small specialist manufacturer of gra-phic engines, has moved to position 30 in this ranking with growth of 81%. We can read from this, even in bad times and against all odds, good news can be possible.

Advanced Micro Devices (AMD), was another success story, moving into the top-10 from 16th place. However, AMD’s sales of nearly $3.9bn in 2001 were almost $2.4bn lower than the revenues required to be ranked in the top-10 in the year before. Intel Corp. also ranked among the winners, with its revenue declining by only 22.1%, helping it to retain its absolutely dominant worldwide position. The real impact of the disaster of 2001 may be a trend among semiconductor suppliers to develop more rigorous criteria for judging their success.

„As companies learn from the lessons of 2001, they are developing new strategies for survival – and survival probably is the most accurate word to describe the mindset of many companies“, noted Joe D’Elia, director for iSuppli Europe. „While this report has described the final market share rankings based on product revenues, many companies are turning their attention to a more critical analysis of their business and developing scorecards and comparisons based on key metrics such as profitability, cash flow, and return on invested capital.“

Gerhard B. Wolski

Share: